Summary

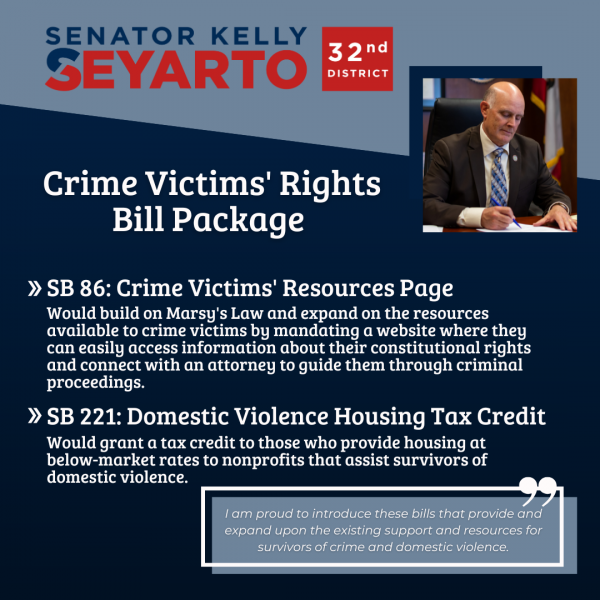

SB-221 will grant a tax credit to individuals who provide housing at below market rates to non-profit service providers assisting domestic violence survivors with housing.

Background

Domestic violence is one of the primary causes of homelessness for women and their children. According to the National Network to End Domestic Violence, between 22 and 57 percent of women and children are homeless due to domestic violence, of them, 38 percent will experience homelessness at some point in their lives.

In 2019-20 alone, California Office of Emergency Services Domestic Violence (DV) Assistance Program served almost 19,000 individuals in their shelters, which accounted for over 600,000 nights. Still, almost 28,000 requests for shelter went unmet. On average, women wait more than 10 years to access stable housing – a rate twice that of men. Furthermore, women account for 65% of all unhoused and nearly half of this population reported domestic violence.

California continues to be at the forefront of innovative responses to homelessness and domestic violence by ensuring relevant service providers, like non-profits, are incorporated into local planning. Unfortunately, the strain on housing resources within the state limits the ability of non-profits to offer housing resources to survivors of domestic violence. Non-profits cite California’s high cost rental markets and landlord reluctance as a hindrance in identifying partners. With non-profits struggling to provide housing for domestic violence survivors, creating an incentive structure for these partnerships will close the housing gap for survivors of domestic violence.

Proposal

SB-221 grants a tax credit to individuals partnered with non-profit service providers dedicated to assisting with providing Transitional Housing at below market rates to survivors of domestic violence. The tax credit will be equal to the difference between the discounted rate at which individuals rent to nonprofits and the market housing rate.