Summary

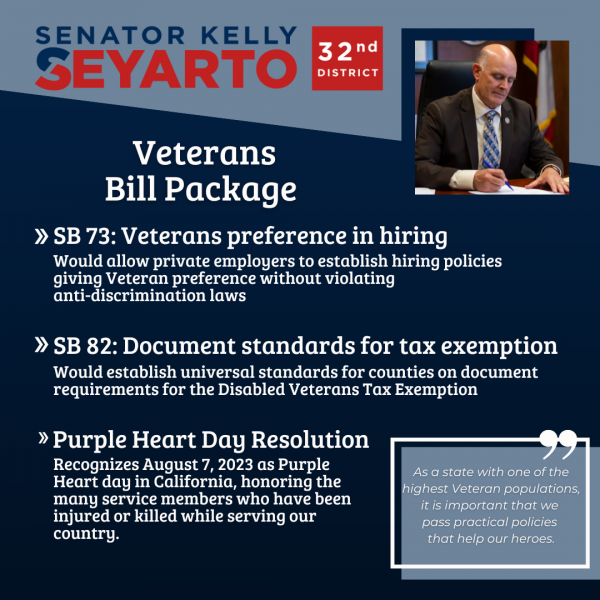

SB-82 establishes universal standards between counties on document requirements for the Disabled Veterans Property Tax Exemption.

Background

Under existing law, Veterans who have suffered injuries in their service and are rated as totally disabled by the Veterans Administration (VA), qualify for a property tax exemption. The Veteran must have served honorably during their service and be authenticated through Federal Documentation as both honorable and completely disabled due to service-connected injury or disease. This exemption is applicable to the Veterans primary residence and is adjusted for market index each year.

In 2019, the VA reported that approximately 73,000 Veterans lived in California and were rated as completely disabled through service-connected injuries. Additionally the VA reports that 50.5% of Veterans living in California are 65 years and older, with that population decreasing by approximately 25,000 per year since 2015.

Veterans who apply for the Disabled Veterans Property Tax Exemption currently apply for the exemption through their county assessor’s office by affirming that the house is their primary residence, providing the copy of their DD-214 as proof of service and honorable discharge, and submitting their VA proof of service-connected complete disability. Currently county assessors are given flexibility with determining the proof of VA awarded disability. This has created the situation where some counties exclusively accept one form of proof and other counties accept a different form of proof. Unfortunately, some counties have opted for unreasonable forms of evidence that act as a barrier to entry for Veterans to apply for their well-deserved and already qualified benefits.

Proposal

SB-82 will provide for only two methods of acceptable proof counties may accept from a Veteran applying for Disabled Property Tax Exemption for the purpose of establishing their service-connected disability; Either an original VA letter or an electronically VA generated letter shall be accepted and both shall be treated equally.